Appendix B: Custom Functions

Streaming Data: SYM()

=SYM(<data-identifier>,<data-property>,<data-attribute>,<interval-multiplier>,<interval-type>,<index>,<date-time>)

|

Description |

Values | |

|---|---|---|

|

Data Identifier |

The identifier of the data that will be added to the cache: the instrument name |

Symbol strings, e.g. EUR/USD or IBM |

|

Data Property |

The data property, if any: e.g. for symbol price data, a property might be Bid or Ask quotes or Last for the trade price |

Strings for available data streams, currently BID, ASK, MID |

|

Data Attribute |

The data attribute, e.g., for symbol price data, this might be Open, High, Low, Close or Volume |

Strings for available data attributes, currently Open, High, Low, Close, Volume, or their abbreviations: O, H, L, C, V |

|

Interval Multiplier |

An argument that specifies the multiplier used by the data aggregation method to perform data aggregation. For example, "10" if coupled with an <interval-type> of "Seconds" would then cause the data to be aggregated using the appropriate aggregation method in 10 second intervals. Aggregation methods are mapped to <data-property> and/or <data-attribute> types. For example, if the <data-attribute> is "H" for the high of an instrument price, the aggregation method for computing the highest value in all the underlying substrate data would be used, and the high value would be returned for each 10 second interval. If <interval-multiplier> is specified at "T", tick data is returned and the <interval-type would not be specified. |

An integer that is combined with the interval type to comprise the data frequency, e.g. 10 for 10 seconds, hours, minutes, etc. |

|

Interval Types |

An optional argument that specifies the aggregation method. For instrument price data it might be seconds, minutes, hours, days, weeks, months, years. If <interval-multiplier> is specified as "T" for the tick interval-type, then <interval-type> is not specified. |

String for supported intervals, e.g. Tick Second, Minute, Hour, Day, Week, Month |

|

Index |

The index in the time series which is stored in the cache, where 0 is the most recent value, 1 is the second value, etc. Optionally specifying a range of indices such as 0-5 causes most recent 6 values to be added to the cache. |

Integer starting with 0 or a hyphenated index range if entering a streaming range, e.g. 0-10 or 5-15, etc. |

|

Date Time |

An optional argument that if specified will cause the date time of the index or indices specified to be returned instead of the actual value. This is typically used in an adjacent column |

The string DT |

|

Example Formulas |

=sym(EUR/USD,B,O,1,MI,0) - returns Bid Open price for current minute for EUR/USD. =sym(EUR/USD,A,C,1,MI,1) - returns Ask Close price for the previous minute for EUR/USD. =sym(EUR/USD,B,T,0) - returns current Bid price for EUR/USD (price of last bid tick). =sym(EUR/USD,M,C,1,H,5) - returns 5 hours old Close Mid price for EUR/USD. =sym(EUR/USD,A,C,1,MI,0,BDT) - returns current time (in minutes).

| |

Trading: TRD(), OCO(), CAN(), CNR(), CLO()

Custom function TRD() activates trading templates.

=TRD("account","<named-range>",<timer>)

|

Argument |

Description |

Values |

|---|---|---|

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias |

|

Named Range |

The case sensitive string identifier of any named range |

any comma separated list of double quoted named ranges, e.g., "<named-range-1>","<named-range-2>" etc. and/or grouped trades: "OCO | <named-range-1> | <named-range-2>" etc., or a combination of the two, for example: "OCO|<named-range-1>|<named-range-2>","<named-range-3>","<named-range-4>" |

|

Timer |

An argument for specifying a minimum time based distance between trades from calling the function |

Integer in milliseconds, unquoted, e.g. 5000. If not supplied, uses the global timer value in Trading ->Options |

|

Example Formula |

=IF(F22="BUY",TRD("A", "BuyEntry",5000),"HOLD") - if cell F22 equal to "Buy", "BuyEntry" trading template is activated. Otherwise "HOLD" displayed. Trading template will wait 5000 milliseconds (5 seconds) to execute next order. | |

Custom function OCO() places OCO orders (One-Cancels-the-Other).

=OCO("<account>","<named-range>","<named-range>",<milliseconds>)

|

Argument |

Description |

Values |

|---|---|---|

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias |

|

Named Range |

The case sensitive string identifier of any named range |

any comma separated list of double quoted named ranges, e.g., "<named-range-1>","<named-range-2>" etc. and/or grouped trades: "OCO | <named-range-1> | <named-range-2>" etc., or a combination of the two, for example: "OCO|<named-range-1>|<named-range-2>","<named-range-3>","<named-range-4>" |

|

Timer |

An argument for specifying a minimum time based distance between trades from calling the function |

Integer in milliseconds, unquoted, e.g. 5000. If not supplied, uses the global timer value in Trading ->Options |

|

Example Formula |

=IF(F22="BUY",TRD("A", "EntryLmt","EntryStp",5000),"HOLD") - if cell F22=Buy places place an OCO order by utilizing EntryLmt and EntryStp templates. If one of the orders is executed (or canceled), the second one is canceled as well. | |

Custom function CAN() cancels pending orders.

= CAN("<account>","<scope>","<side>|<order-type>",<timer>)

|

Argument |

Description |

Values |

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias |

|

Scope |

Portfolio or Symbol Name |

Double quoted string “Portfolio” or “Symbol Name” e.g. “EUR/USD” |

|

Side|Order Type |

Allows a specification of which orders to cancel by whether the order is a buy, sell, or both, together with the type of order |

Double quoted <side>|<order-type> list with pipe delimiter; Buy and/or Sell and/or BuySell | EntryLimit and/or EntryStop and/or OCO and/or StopNet and/or LimitNets; for example: "Buy | EntryLimit | OCO; Sell | OCO; BuySell | EntryStop" |

|

Timer |

An argument for specifying a minimum time based distance between trades from calling the function |

Integer in milliseconds, unquoted, e.g. 5000. If not supplied, uses the global timer value in Trading ->Options |

|

Example Formula |

=IF(C14>0,CAN("A","EUR/USD","Buy|EntryLimit;Buy|EntryStop",5000),"HOLD") - if cell C14>0, all "Buy" orders of type "EntryLimit" and "EntryStop" are canceled. Otherwise "HOLD" displayed. Trading template will wait 5000 milliseconds (5 seconds) to execute next order. =IF(C14>0,CAN("A","Template","BuyEntry",SellEntry",5000),"HOLD")- if cell C14>0, all orders originated from templates "BuyEntry" and "SellEntry" will be canceled. Otherwise "HOLD" displayed. Trading template will wait 5000 milliseconds (5 seconds) to execute next order. | |

Custom function CNR() replaces one pending order with another.

=CNR("<account>","<scope>","<side>|<order-type>","<trigger>","<replacement-trades...>",<timer>)

|

Argument |

Description |

Values |

|---|---|---|

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias |

|

Scope |

Portfolio or Symbol Name |

Double quoted string “Portfolio” or “Symbol Name” e.g. “EUR/USD” |

|

Side|Order Type |

Allows a specification of which orders to cancel by whether the order is a buy, sell, or both, together with the type of order |

Double quoted <side>|<order-type> list with pipe delimiter; Buy and/or Sell and/or BuySell | EntryLimit and/or EntryStop and/or OCO and/or StopNet and/or LimitNets; for example: "Buy | EntryLimit | OCO; Sell | OCO; BuySell | EntryStop" |

|

Trigger |

Allows specification of the conditions under which the replacement trade orders should be submitted; OnCancelled means only issue the replacement orders if the specified order-types to be cancelled are found and cancelled, OnNoCancel means to only issue the replacement orders if there are no orders found to cancel matching the specifications, OnProcessed means to issue the replacement trades whenever the function is called, and OnFail means to only submit the replacement orders when the attempt to cancel the specified orders fails |

double quoted option names "OnCanceled" or "OnNoCancel" or "OnProcessed" or "OnFail" |

|

Replacement Trades |

Allows specification of any number of replacement trades of any type of order represented by a named range. Also supports groups of trades such as OCO orders as well as combinations of the two |

Double quoted comma delimited named ranges, e.g., "<named-range-1>","<named-range-2>" and/or double quoted groups of trades, e.g., "OCO | <named-range-1> | <named-range-2>", or a combination of the two, for example "OCO | BuyLimit | BuyStop", "BuyEntryLimit", "BuyEntryLimit-Level2" where: each of BuyLimit, BuyStop, BuyEntryLimit and BuyEntryLimit-Level2 are named ranges with the first two submitted as an OCO |

|

Timer |

An argument for specifying a minimum time based distance between trades from calling the function |

Integer in milliseconds, unquoted, e.g. 5000. If not supplied, uses the global timer value in Trading ->Options |

|

Example Formula |

=IF(C28>0,CNR("A","EUR/USD","Buy|EntryLimit","OnProcessed","EntryStp",5000),"HOLD") - if cell C28>0 pending buy entry limit order is replaced with trading range named "EntryStp" (may represent entry stop order). | |

Custom function CLO() closes open positions.

= CLO("<account>","<scope>","<side>",<timer>)

|

Argument |

Description |

Values |

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias |

|

Scope |

Portfolio or Symbol Name |

Double quoted string “Portfolio” or “Symbol Name” e.g. “EUR/USD” |

|

Side |

Allows a specification of which positions to cancel by whether the position is a buy (long), sell (short), or both, together with the type of order |

Double quoted <side> list with pipe delimiter; Buy and/or Sell and/or BuySell. For example: "Buy", "Sell", "BuySell". |

|

Timer |

An argument for specifying a minimum time based distance between trades from calling the function |

Integer in milliseconds, unquoted, e.g. 5000. If not supplied, uses the global timer value in Trading ->Options |

|

Example Formula |

=IF(A1<-20, CLO("A","EUR/USD","BuySell",5000),"HOLD") - if cell A1<-20 all open positions for EUR/USD will be closed and formula will wait at least 5000 millisecond between cancels even if called by the formula (i.e. if A<-20 evaluates to True). The "HOLD" is a user specified string which the value returned in the cell if the IF() formula evaluates to False. | |

Real Time Feedback Loop: ORD(), POS(), CSD()

Custom function ORD() shows parameters of pending orders.

=ORD("<account>","<scope>","<side>|<order-type>","<Rate>","Tag|<tag-string>", "user")

|

Argument |

Description |

Values | |

|---|---|---|---|

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias | |

|

Scope |

Portfolio or Symbol Name |

Double quoted string “Portfolio” or “Symbol Name” e.g. “EUR/USD” | |

|

Side|Order Type |

Allows a specification of which orders to cancel by whether the order is a buy, sell, or both, together with the type of order |

Double quoted <side>|<order-type> list with pipe delimiter; Buy and/or Sell and/or BuySell | EntryLimit and/or EntryStop and/or OCO and/or StopNet and/or LimitNets; for example: "Buy | EntryLimit | OCO; Sell | OCO; BuySell | EntryStop" | |

|

Rate (optional) |

Shows rate (price) at which order was placed. |

Double quoted word "Rate". | |

|

Tag|tag-string (optional) (Available for institutional platforms only) |

Tag that allows identification of given trade. | Double quoted combination of symbols (limited to 24) | |

|

User (optional) (Available for Super Users only) |

In Super User account will display net quantity for all accounts or net quantity for each separate account | Double quoted word "total" or double quotes username (user@FXOne.com) | |

|

Example Formula |

=ORD("A","EUR/USD","Buy|EntryLimit") - will show quantity all Buy|EntryLimit pending orders =ORD("A","EUR/USD","Buy|EntryLimit;Sell|EntryLimit") - will show quantity of all Buy|EntryLimit and Sell|EntryLimit pending orders =ORD("A","EUR/USD","Buy|EntryLimit","Tag|1") - will show quantity of all Buy|EntryLimit pending orders with tag "1". =ORD("A","EUR/USD","Buy|EntryLimit","Rate") - will show rate(price) of first Buy|EntryLimit order. =ORD("A","EUR/USD","Buy|EntryLimit","total")- in Super User account will show quantity for all EUR/USD Buy|EntryLimit pending orders from all user. (Net Quantity) =ORD("A","EUR/USD","Buy|EntryLimit","user@FXOne.com")- in Super User account will show quantity for all EUR/USD Buy|Entrylimit pending orders for user user@FXOne.com. (Net Quantity).

| ||

Custom function POS() shows parameters of open positions

=POS("<account>","<scope>","<value>")

|

Argument |

Description |

Values |

|---|---|---|

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias |

|

Scope |

Portfolio or Symbol Name |

Double quoted string “Portfolio” or “Symbol Name” e.g. “EUR/USD” |

|

Value |

Allows specification of any available value computed in real-time related to currently open positions |

Can be any double quoted value available via the API or computed from information available via the API or information maintained by the application, e.g., "NetPL". Currently available values include: · “GrossPL” -- current gross profit and loss · “NetPL” -- current net profit and loss · “AmountK” -- amount of all positions (both buy and sell) opened in the instrument. · “SellNetPL” -- current profit and loss on all sell positions · “SellAmountK” -- amount of all open sell positions · “SellAvgOpen” -- average open price of buy positions · SellClose -- current market price at which all sell positions can be closed. · “BuyNetPL” -- current net profit and loss on all buy positions · “BuyAmountK” -- amount of all open buy positions · “BuyAvgOpen” -- average open price of buy positions “BuyClose” -- current market price at which all buy positions can be closed. |

|

User (optional) (Available for institutional platforms only) |

In Super User account will display net quantity for all accounts or net quantity for each separate account | Double quoted word "total" or double quotes username (user@uFXOne.com) |

|

Example Formula |

=POS("A","EUR/USD","BuyNetPL") - returns current net profit and loss on all buy positions. =POS("A","EUR/USD","NetPL") - returns current net P/L. =POS("A","EUR/USD") - returns total quantity of all open positions. =POS("A","EUR/USD","AmountK,"total") - in Super User account will display quantity for for all open EUR/USD positions from all users (Net Quantity). =POS("A","EUR/USD","AmountK",user@fFXOne.com) - in Super User account will show quantity for all open EUR/USD positions for user user@FXOne.com (Net Quantity). | |

function CSD() displays parameters of the closed position.

|

Please note that the first closed trade displayed is not necessary today's first trade, but the first trade of the current trading cycle. |

=CSD("<account>","<scope>","<side>","<value>",<index>, "Tag|<tag-string>")

|

Argument |

Description |

Values | ||

|---|---|---|---|---|

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias | ||

|

Scope |

Portfolio or Symbol Name |

Double quoted string “Portfolio” or “Symbol Name” e.g. “EUR/USD” | ||

|

Side |

Allows specification of which closed orders to return by whether the order is a buy, sell or both |

Double quoted strings “Buy”, “Sell” or “BuySell” | ||

|

Value |

allows specification of any available value computed in real-time related to currently open positions |

Can be any double quoted value available via the API or computed from information available via the API or information maintained by the application, e.g., "NetPL". Currently available values include: · “GrossPL” -- current gross profit and loss · “NetPL” -- current net profit and loss · “AmountK” -- amount of all positions (both buy and sell) opened in the instrument. · “SellNetPL” -- current profit and loss on all sell positions · “SellAmountK” -- amount of all open sell positions · “SellAvgOpen” -- average open price of buy positions · SellClose -- current market price at which all sell positions can be closed. · “BuyNetPL” -- current net profit and loss on all buy positions · “BuyAmountK” -- amount of all open buy positions · “BuyAvgOpen” -- average open price of buy positions “BuyClose” -- current market price at which all buy positions can be closed. | ||

|

Index (optional) |

The index in the time series which is stored in the cache, where 0 is the most recent value, 1 is the second value, etc. ; optional argument, defaults to 0 |

An integer starting with 0 | ||

|

Tag|<tag-string> (optional) (Available for institutional platforms only) |

Tag that allows identification of given trade. | Double quoted combination of symbols (limited to 24) | ||

|

Example Formula |

=CSD("A", "EUR/USD","BuySell", "Open", 0) - displays open price of the first trade. (buy or sell) =CSD("A", "EUR/USD","BuySell", "PL", 0) - displays P/L of the first trade (buy or sell) =CSD("A", "EUR/USD","BuySell", "OpenTime", 0) -displays opening time of the first trade (buy or sell) =CSD("A", "EUR/USD","BuySell", "Open", 0,"Tag|1") - displays open price of the first trade with tag 1. (buy or sell) =CSD("A", "EUR/USD","BuySell", "PL", 0,"Tag|1") - displays P/L of the first trade with tag 1 (buy or sell) =CSD("A", "EUR/USD","BuySell", "OpenTime", 0,"Tag|1") -displays opening time of the first trade tag 1 (buy or sell) =CSD("A", "EUR/USD","BuySell", "Close", -1) – displays price for the last closed long or short EUR/USD position =CSD("A", "EUR/USD","BuySell", "Close", -1,"Tag|1") – displays price for the last closed long or short EUR/USD position with tag 1 Volume

=CSD("A", "EUR/USD","BuySell","Grosspl", "Vol")- displays GrossP/L of today's trades (buy or sell). =CSD("A", "EUR/USD","BuySell","PL", "Vol") - displays P/L of today's trades (buy or sell) =CSD("A", "EUR/USD","BuySell","Amount", "Vol") - displays today's total trading volume =CSD("A", "EUR/USD","BuySell","AmountK", "Vol") - displays today's total trading volume in thousands

=CSD("A", "EUR/USD","BuySell", "PL", 0,"Tag|1") - displays P/L of the first trade with tag 1 (buy or sell) =CSD("A", "EUR/USD","BuySell", "OpenTime", 0,"Tag|1") -displays opening time of the first trade tag 1 (buy or sell) =CSD("A", "EUR/USD","BuySell", "Close", -1) – will display price for the last closed long or short EUR/USD position =CSD("A", "EUR/USD","BuySell", "Close", -1,"Tag|1") – will display price for the last closed long or short EUR/USD position with tag 1

=CSD("A", "EUR/USD","BuySell","Grosspl", "Vol","user@FXOne.com")- displays GrossP/L of today's trades (buy or sell) from specific user. | |||

Custom function DPL() displays account's real time day's P/L.

=DPL("<account>","<currency>","<symbol>","<user>")

|

Argument |

Description |

Values |

|---|---|---|

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias |

|

Currency (optional) |

Convert account P/L from base currency into given currency | Double quoted currency name |

|

Currency (optional) |

Returns daily P/L for a given symbol | Double quoted currency name |

|

Symbol (optional) |

Returns daily P/L for a given symbol | Double quoted currency pair |

| Example Formula |

=DPL("A","EUR","AUD/CAD", "user@FXOne.com") - returns unrealized and realized P/L for user user@FXOne.com for symbol AUD/CAD and displays result using EUR currency. (You can see other trader's P/Ls only if you are a Super User)

=DPL("A") - returns total unrealized and realized P/L for all users in account's base currency. =DPL("A","GBP") - returns total unrealized and realized P/L for all users in GBP. = DPL("A","USD/CHF") - displays unrealized and realized P/L for a given currency pair ( total for all accounts if you are a Super User) =DPL("A","USD/CHF", "user@FXOne.com") - displays unrealized and realized P/L for a given currency and user. | |

Custom function UPL() displays account's real time unrealized day's P/L.

=UPL("<account>","<currency>","<symbol>","<user>")

Argument Description Values The account number or alias Double quoted actual account number or recorded alias Currency (optional) Symbol (optional) User (optional) (Available for institutional platforms only) =UPL("A","EUR","AUD/CAD", "user@FXOne.com") - returns unrealized P/L for user user@FXOne.com for symbol AUD/CAD and displays result using EUR currency. (You can see other trader's P/Ls only if you are a Super User) =UPL("A") - returns total unrealized P/L for all users in account's base currency. =UPL("A","GBP") - returns total unrealized P/L for all users in GBP. = UPL("A","USD/CHF") - displays unrealized P/L for a given currency pair ( total for all accounts if you are a Super User) =UPL("A","USD/CHF", "user@FXOne.com") - displays unrealized P/L for a given currency and user.

Account

Convert account P/L from base currency into given currency

Double quoted currency name

Returns unrealized P/L for a given symbol

Double quoted currency pair

Returns unrealized profit for a given user (You can see other traders P/Ls only if you are a Super User)

Double quoted username

Example Formula

=UPL("A","EUR", "user@FXOne.com") - returns total unrealized P/L for user user@FXOne.com and displays result using EUR currency.(You can see other trader's P/Ls only if you are a Super User).

Custom function RPL() displays account's real time realized day's P/L.

=RPL("<account>","<currency>","<symbol>","<user>")

|

Argument |

Description |

Values |

|---|---|---|

| Account |

The account number or alias |

Double quoted actual account number or recorded alias |

|

Currency (optional) |

Convert account P/L from base currency into given currency | Double quoted currency name |

|

Symbol (optional) |

Returns realized P/L for a given symbol | Double quoted currency pair |

|

User (optional) (Available for institutional platforms only)

|

Returns realized profit for a given user (You can see other traders P/Ls only if you are a Super User) | Double quoted user name |

| Example Formula |

=RPL("A","EUR","AUD/CAD", "user@FXOne.com") - returns realized P/L for user user@FXOne.com for symbol AUD/CAD and displays result using EUR currency. (You can see other trader's P/Ls only if you are a Super User)

=RPL("A") - returns total realized P/L for all users in account's base currency. =RPL("A","GBP") - returns total realized P/L for all users in GBP. = RPL("A","USD/CHF") - displays realized P/L for a given currency pair ( total for all accounts if you are a Super User) =RPL("A","USD/CHF", "user@FXOne.com") - displays realized P/L for a given currency and user. | |

|

RPL() resets to zero at 5PM US Eastern Time |

|

DPL=UPL+RPL |

Custom function ACT() displays account's real time parameters

=ACT("<account>","<value>")

|

Argument |

Description |

Values | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias | ||||||||||||||||||

|

Value |

Allows specification of any available value computed in real-time related to currently open positions |

Can be any double quoted value available via the API or computed from information available via the API or information maintained by the application, e.g., "GrossPL". Currently available values include: · “GrossPL” -- The profit and loss on all open positions in the account. The GrossPL equals the difference between the Equity and the Balance of the account. · “Balance” -- The amount of funds in the account without taking into consideration profits and losses on all open positions · “Equity” -- the amount of funds in the account, including profits and losses on all open positions (the "floating" balance of the account) · “DayPL” -- The profit and loss (both "floating" and realized) during the current trading day. · “M2MEquity” -- The "floating" balance of the account at the beginning of the trading day.· “UsableMargin” -- available margin · "UsedMargin" -- The amount of funds currently committed to maintain all open positions in the account. · "MarginCall” -- The limitation state of the account, each state determines the operations that can be performed on the account. Possible values:

· “IsUnderMarginCall” -- Defines whether the account is under the margin call process. Possible values: "True" - the account is under the margin call (the UsableMargin reached "0" and open positions were closed because of the insufficient funds), "False" - the account is not under the margin call (there are funds available to open new position and cover losses on the existing positions). · “Kind” -- The type of the account. Possible values:

| ||||||||||||||||||

|

Example Formula |

=ACT("A","GrossPL") - shows current gross profit and loss =ACT("A","DayPL") - shows current daily PL | |||||||||||||||||||

|

You can have the same tag with different currencies. |

|

TPOS() available for institutional platforms only. |

Custom function TPOS() shows parameters of open positions with corresponding tag.

=TPOS("<account>","<scope>","<value>",<"tag-string">,"user")

|

Argument |

Description |

Values |

|---|---|---|

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias |

|

Scope |

Portfolio or Symbol Name |

Double quoted string “Portfolio” or “Symbol Name” e.g. “EUR/USD” |

|

Value |

Allows specification of any available value computed in real-time related to currently open positions |

Can be any double quoted value available via the API or computed from information available via the API or information maintained by the application, e.g., "NetPL". Currently available values include: · “GrossPL” -- current gross profit and loss · “NetPL” -- current net profit and loss · “AmountK” -- amount of all positions (both buy and sell) opened in the instrument. · “SellNetPL” -- current profit and loss on all sell positions · “SellAmountK” -- amount of all open sell positions · “SellAvgOpen” -- average open price of buy positions · SellClose -- current market price at which all sell positions can be closed. · “BuyNetPL” -- current net profit and loss on all buy positions · “BuyAmountK” -- amount of all open buy positions · “BuyAvgOpen” -- average open price of buy positions “BuyClose” -- current market price at which all buy positions can be closed. |

|

Tag-string |

Tag that allows identification of given trade. | Double quoted combination of symbols (limited to 24). |

|

User (optional) (Available for institutional platforms only) |

In Super User account will display net quantity for all accounts or net quantity for each separate account | Double quoted word "total" or double quotes username (user@uFXOne.com) |

|

Example Formula |

=TPOS("A","EUR/USD","SellAvgOpen,"2") shows average open price for all EUR/USD sell trades with tag "2". =TPOS("A","EUR/USD","BuyAmountK","1") shows the trade amount of all positions opened in the instrument with the direction "buy" with tag "1". =TPOS("A","EUR/USD","NetPL","1") will show you NetPL all trades with tag "1". =TPOS("A","EUR/USD","AmountK","1","total") ins Super User account will display quantity for all open EUR/USD positions with tag "1" from all users (Net Quantity). =TPOS("A",EUR/USD","AmountK","1",user@FXOne.com) -in Super User account will displays quantity for all open EUR/USD positions for user user@FXOne.com (Net Quantity). | |

|

TCAN() available for institutional platforms only. |

Custom Function TCAN() cancels pending orders with corresponding tag.

=TCAN("<account>","<scope>","<value>",<"tag-string">,<tiemr>)

|

Argument |

Description |

Values |

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias |

|

Scope |

Portfolio or Symbol Name |

Double quoted string “Portfolio” or “Symbol Name” e.g. “EUR/USD” |

|

Side|Order Type |

Allows a specification of which orders to cancel by whether the order is a buy, sell, or both, together with the type of order |

Double quoted <side>|<order-type> list with pipe delimiter; Buy and/or Sell and/or BuySell | EntryLimit and/or EntryStop and/or OCO and/or StopNet and/or LimitNets; for example: "Buy | EntryLimit | OCO; Sell | OCO; BuySell | EntryStop" |

|

Timer |

An argument for specifying a minimum time based distance between trades from calling the function |

Integer in milliseconds, unquoted, e.g. 5000. If not supplied, uses the global timer value in Trading ->Options |

| Tag-string | Tag that allows identification of given trade. | Double quoted combination of symbols (limited to 24). |

|

Example Formula |

=TCAN("A","EUR/USD","Buy|EntryLimit","1",3000) - cancels "Buy" EntryLimit order with tag "1". =TCAN("A","EUR/USD","Buy|EntryLimit;Buy|EntryStop","1",5000) - cancels "Buy" EntryLimit and "Buy" EntryStop orders with tag "1." | |

|

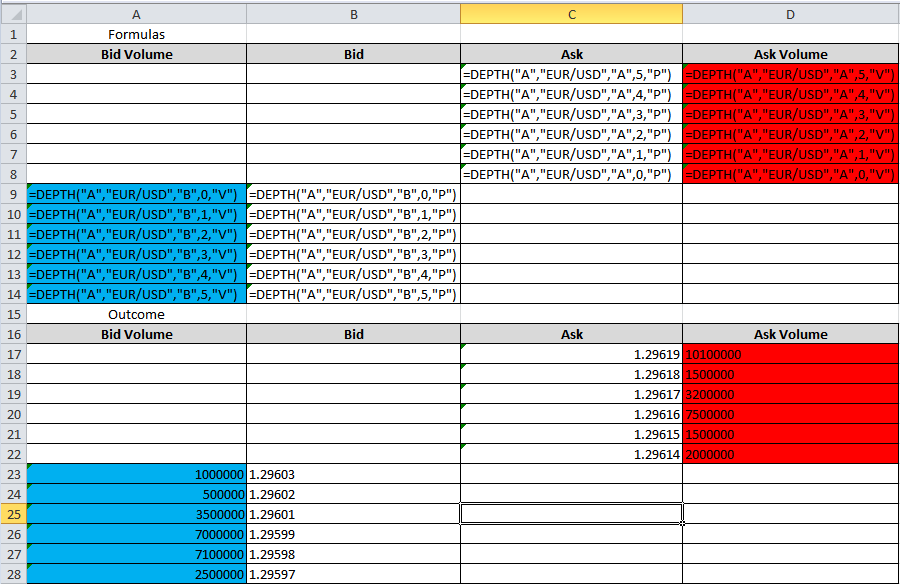

DEPTH() available for institutional platforms only. |

Custom Function DEPTH() displays price ladder and trading volume.

=DEPTH(<account>,<scope>,<side>,<index>,<"V"|"P">)

Argument Description Values Account The account number or alias Double quoted actual account number or recorded alias Scope Portfolio or Symbol Name Double quoted string “Portfolio” or “Symbol Name” e.g. “EUR/USD” Side Allows a specification of trading order side (Bid or Ask) Bid or Ask ("B" or "A") Index The index in the time series which is stored in the cache, where 0 is the most recent value, 1 is the second value, etc. Integer starting with 0. If <index> = "S" - summary of all depth for this side V|P (optional) Example Formula =DEPTH("A","EUR/USD","B","S") - returns summary of all bid orders =DEPTH("A","EUR/USD","B","S","V") - returns summary of volumes The following example shows how to build price ladder by utilizing DEPTH()

Volume or price at the given index

Volume or Price ("V" or "P")

|

VWAP() available for instituional platforms only. |

Custom Function VWAP() displays volume-weighted average price (VWAP).

=VWAP(<account>,<scope>,<side>,<volume>)

|

Argument |

Description |

Values | |

|---|---|---|---|

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias | |

|

Scope |

Portfolio or Symbol Name |

Double quoted string “Portfolio” or “Symbol Name” e.g. “EUR/USD” | |

|

Side |

Allows a specification of trading order side (Bid or Ask) |

Bid or Ask ("B" or "A") | |

|

Volume |

Allows a specification of desired trading volume. |

Integer. If "0" specified VWAP for all depth levels will be displayed. | |

|

Example Formula |

=VWAP("A","EUR/USD","B",20000000) - displays price at which we can sell 20000000 lots. | ||

Custom Function TRADESTATUS() displays current trading status.

=TRADESTATUS(<scope>)

|

Argument |

Description |

Values | |

|---|---|---|---|

|

Scope |

Status name |

Double quoted string "Fully-Auto", "Semi-Auto" or "Disabled". | |

|

Example Formula |

=TRADESTATUS("Fully-Auto") dispalys TRUE when the trading is in Fully-Auto mode and FALSE when trading is disabled. | ||

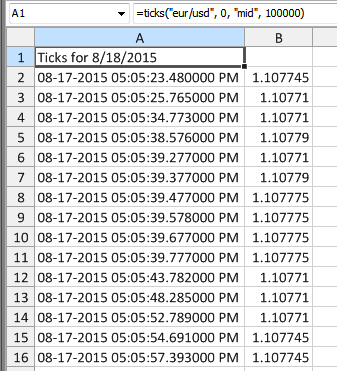

Custom Function ticks() strems ticks down the row.

=ticks(symbol, daysInThePast, priceType, maxRows)

|

Argument |

Description |

Values | |

|---|---|---|---|

|

symbol |

Symbol Name |

Double quoted string “Symbol Name” e.g. “EUR/USD” | |

| daysInThePast | This parameter specifies the date for the data. For instance, in order to see today’s data you have to specify a 0, to see yesterday’s data you have to specify 1. Day starts at 5PM ET day before. | Integer | |

| priceType |

Allows a specification of trading order side (Bid, Ask, Mid) |

bid, ask, mid | |

| maxRows | Max rows to extend the formula to the bottom | Integer | |

|

Example Formula |

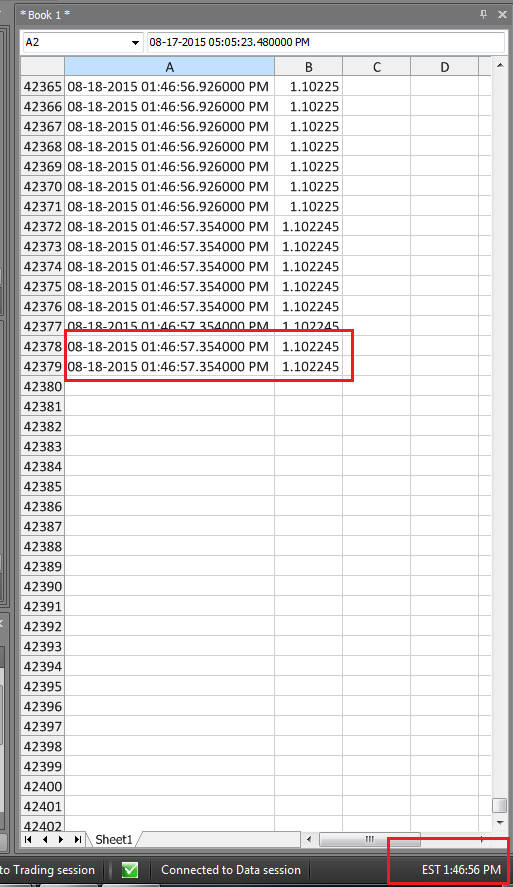

Example 1: Today is 8/18 and you want to fill the column with the most recent ticks for the past day. The following formula =ticks("eur/usd", 0, "mid", 100000) placed in cell A1 results in column A being filled (starting from cell A2) with mid EUR/USD ticks. Since “maxRow” number is large enough the first tick starts at 5PM on 8/17 – up to present moment. (In other word, if today is 8/18, and the “daysInThePast” equal to zero, the first tick will start at 5PM ET on 8/17). However, the header will say “Ticks for 8/18/2015”

On screenshot bellow you can see that current time is 1:46 PM 8/18 and column is being populated with most recent ticks (only 42,378 rows are used out of maximum permitted 100,000). Most likely all 100,000 rows will not be filled up until 5PM so you will have 100K rows worth of data

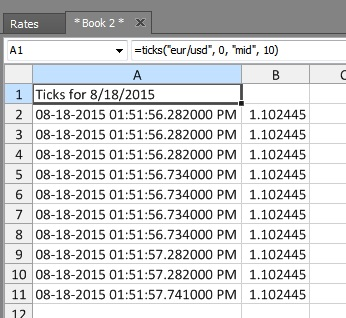

Example 2: =ticks("eur/usd", 0, "mid", 10) – it will display most recent 10 EUR/USD mid ticks. Since 10 is a really small number the row will be constantly re-populated.

| ||

Custom function RESET() resets template status to "Ready".

=RESET("<account>","<templatename>",<millisconds>)

|

Argument |

Description |

Values |

|---|---|---|

|

Account |

The account number or alias |

Double quoted actual account number or recorded alias |

| Templatename | Allows specification of template's name | Name of the trading template that needs to be reset |

| Milliseconds |

An argument for specifying a minimum time based distance between trades from calling the function |

Integer in milliseconds, unquoted, e.g. 5000 |

| Example Formula | =IF(E14>0,RESET("A","BuyLimit",5000),"HOLD") - if value of cell E14 is greater than zero, status of trading template named "BuyLimit" is reset to "Ready" (template is ready to place a new order). | |

|

"RESET()" works when workbook in "Fully-Auto" mode only. |